Albert Einstein once referred to compound interest as the 8th wonder of the world. And it can be quite wonderful if you get on the correct side of it. If you are on the wrong side of it, compound interest can be your worst enemy. Today we will examine compound interest and discuss how it can benefit you and how it can hurt you.

Listen Here!

First, How Does Compound Interest Work?

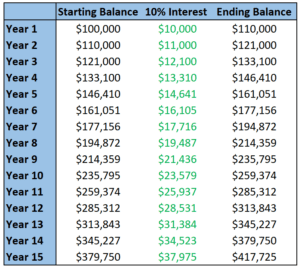

When interest is compounded, the new interest amount is added to the original principal amount, plus any accrued interest. Moving forward, the interest rate will be applied to the new total balance. This is easiest to understand with a visual example.

Above, you can see a starting balance of $100,000. Let’s assume there is a 10% annual interest rate attached to it. And the interest compounds annually.

10% of $100,000 is $10,000. So, after one year, the new balance will be $100,000 plus the $10,000 of interest which adds up to $110,000. This then becomes the starting balance for year two.

In year two, the 10% interest rate is applied to the $110,000 balance. 10% of $110,000 is $11,000. So, after year two, the new balance will be $121,000.

In year three, the 10% interest rate is applied to the $121,000 balance. 10% of $121,000 is $12,100. That gests added to the starting balance of $121,000. So, after year two the total amount is $133,100.

If this continues, you can see how the interest continues to grow and compound on top of itself.

If this were simple interest, rather than compound interest, $10,000 of interest would be applied each and every year. With simple interest, the interest amount is calculated on the original principal – not including any accrued interest.

If the above example is an investment, this can work out fantastically for you. The more time you have to let it compound, the greater it can become. Now, this is a hypothetical example and isn’t reflective of any real investment. An actual investment could have variation in returns and even potential losses, including total loss of principal. But for illustrative purposes, you get the idea.

If this is a debt, that compound interest can work aggressively against you. After 10 years, the balance has increases by more than 150%. That is quite the hole to dig out of!

Think about that for a minute. For those of you with debts that you aren’t paying on, or are only paying the minimum balance on, odds are the debt amount is growing exponentially.

For example, if you went to medical school or dental school and have $200,000 in student loan debt with a 7% interest rate, you are accruing $14,000 in interest over the next year if you make no payments. If you go on an income-based payment at the beginning of your career, your minimum payment might only be a few hundred dollars per month. Therefore, the interest alone is $14,000 this year, but you’re only paying around $3,500. The net amount added to your loan balance will be $10,500. So even though you’re making your minimum required payment, your loan balance just grew to $210,500.

7% of $210,500 is $14,735 in interest. If your minimum payment is still around $3,500, you would accrue $11,235 in interest in year two. This would grow your loan debt to $221,735. In two years, thanks to compound interest, you just added $21,735 to your loan amount. And that’s while making payments!

As mentioned earlier, compound interest can work in your favor, or it can work against you.

If you have questions about your financial situation and would like to speak to one of our independent financial advisors, please reach out to us and we would be glad to connect.

Paula and Pete

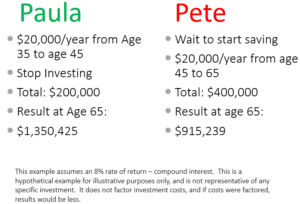

Let’s look at an example of how the power of compound interest can benefit you the earlier you start investing.

In the example below, we have “Paula the Planner” on the left and “Pete the Procrastinator” on the right. We’ll look at Paula first.

Paula is going to start investing $20,000 per year starting at age 35, into a hypothetical investment account that generates an 8% rate of return annually. After ten years of depositing $20,000 per year into this account, she is going to stop making contributions. So, a total of $200,000 has been invested over a 10-year span. Paula will let this investment continue to grow and compound at 8% per year. If it continues that growth rate, at age 65, Paula will have $1.35 million in this account.

Pretty impressive!

Now let’s look at Pete. Instead of starting his investment program at age 35, Pete is going to wait until age 45 to begin investing. He is going to follow the same plan of investing $20,000 per year. However, instead of stopping after ten years, Pete realizes he is getting a later start than Paula, so he is going to deposit $20,000 per year into his account for twenty years, from age 45 to 65. So, he will invest a total of $400,000.

Any guesses on what Pete has at age 65 in his account, assuming it grows at 8% per year, like Paula’s?

If you guessed Pete would have less than Paula, you are correct. Pete still is making out alright. He was able to turn $400,000 into $915,000 in this example. However, Paula was able to turn half as much into 50% more than Pete, simply by starting earlier.

The key takeaway from this example is START INVESTING EARLY! I don’t care how much it is, just start with something. Anything. Put a dollar each paycheck into your 401(k), or a Roth IRA if eligible. If you are already investing, congratulations – increase the amount you are doing by a little bit. The sooner you get started and the more you can save, the sooner you can reach your financial goals.

For those of you wondering how much Paula would have if she continued depositing $20,000/year into her account from age 45 to age 65, she would have $2,265,664. Not too shabby.

In reality, she will probably increase the amount she is investing over time due to increases in income. Even if her income just rises to keep up with inflation, she would be investing over $40,000/year by her 60’s. It is also important to know how much of your income to save for retirement to reach your financial goals.

If you have questions about your financial situation and would like to speak to one of our independent financial advisors, please reach out to us and we would be glad to connect.

Rule of 72

The last thing I am going to leave you with is the rule of 72. This is a simple rule of math that you can use to estimate how long it will take something to double in value at a given interest rate or rate of return.

The rule of 72 states: if you divide 72 by the interest rate, that is how many years it will take for the balance to double.

If the interest rate is 7.2% – 72 divided by 7.2 equals ten – it will take 10 years for the balance to double in value. For example, if you have $100,000 in an investment account and it magically grows by 7.2% per year, in ten years, the account balance will be worth $200,000 (assuming no money was added to the account or taken out of the account).

In 20 years, the balance will be $400,000. In 30 years, the balance will be $800,000. In 40 years, $1.6 million. Every ten years the balance will double.

For those of you with student loans around 7% interest, if you put them into deferment or forbearance and don’t make any payments, the balance will double after ten years.

If the interest rate or rate of return is 10%, the balance will double after approximately 7 years.

At a 3% interest rate, 72 divided by 3 is 24 – the value will double after 24 years. Historically, inflation has averaged around three percent per year. If this continues, you can expect cost of living to double every 24 years. Assuming you maintain the same lifestyle and spending habits over time, 24 years from now it will cost twice as much to live that lifestyle. 48 years from now, life will be four times as expensive for you as it is today.

Therefore, we need to invest and attempt to grow our money over time. If we stick the money under our mattress, we are guaranteed to lose value, due to loss of purchasing power. In 24 years, a dollar will only be worth half as much as it is today.

That Snickers bar at the checkout line in the grocery store will be $2 instead of $1. Gas will be $6 a gallon instead of $3. A $50 pair of pants will cost $100. A $30,000 car will cost $60,000. A $400,000 house will cost $800,000.

If you want to be able to afford life in the future, you need your money to grow for you. So get on the correct side of compound interest and have it start working for you! To speak with a financial advisor to discuss ways to improve your situation, feel free to reach out to us and we would be happy to set up an initial meeting.

Finity Group, LLC

Disclosures:

Any examples are hypothetical and for illustrative purposes. Any investment involves potential loss, include total loss of principal. Consult with your financial advisor before making any investment decision.

- Related Blog Posts: