How do analysts determine the financial health of a business for either investment or lending purposes? While there are several answers to this, Debt to Asset Ratio is one variable used to measure financial solvency. This value is also important for a company because it allows the company to secure additional funding. What is a good debt to asset ratio?

Many analysts look at this formula when making business loan or investment decisions because it reflects the stability and solvency of the company. Other analysist may choose to look at other ratios such as Debt to Equity Ratio (total liabilities divided by total equity), Equity Ratio (total equity divided by total assets), Current Debt to Current Asset Ratio, or Debt to Tangible Assets (long-term debt plus current debt divided by assets minus intangible assets).

How to Calculate Debt to Asset Ratio

Debt to asset ratio, also called debt ratio or total debt to total assets ratio, is calculated by accessing a company’s balance sheet. It is important to note that for practical use of this ratio, there is going to be significant variance in what nuanced variables are used from the balance sheet between both analysts and between industries. This article will focus on one way of calculating this ratio often presented in some textbooks. A commonly used, generic formula for calculating debt to asset ratio is:

Debt to Asset Ratio = (Long-term Debt + Current portion of long-term debt) / Total Assets

For the “debt” portion of the ratio, this calculation generally considers all the current portion due of the long-term debt plus the long-term debt including loans and bonds payable. It should be noted that this calculation does not include accounts payable, underfunded pension liability or shareholder equity.

For the “assets” portion, it includes all assets including accounts receivable, inventory, property and equipment, cash on hand and intangibles. Examples of intangibles would be copyrights and patents

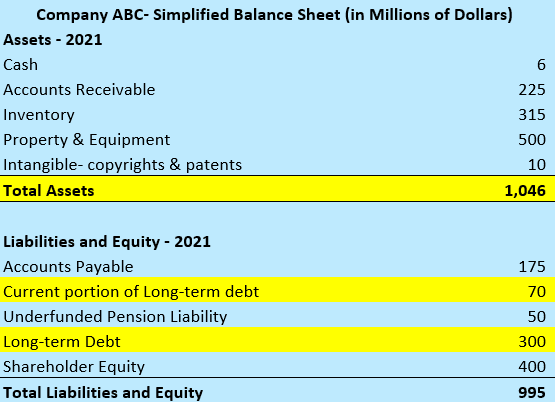

Here is a very simplified example:

In this example, we’ll use the values highlighted in yellow for the calculation:

Debt to Asset Ratio = (300+70) / 1046 = 0.35

A ratio of 0.35 means that Company ABC’s debt funds 35% of the company’s assets. Sometimes this ratio is referred to as 35% instead of 0.35 but it means the same thing.

What is a good debt to asset ratio?

If googling this question, you might get answers like “0.3 to 0.6” if the article is focused on analysis of companies for investment or “Under 0.5” if the article is written from the perspective of a corporate lender. Taken further, there is not only going to be a difference of opinion between lenders and investors (and the time horizon and risk profile of the investor) but there will also be quite a bit of variability between industries.

Since the debt to asset ratio varies a lot between different industries one company with a seemingly high ratio compared to the generic “standard” might actually have a low ratio when to peer companies. One would expect a biotech startup to have a different profile compared to a steel manufacturer. A manufacturing company with a lot of overhead will likely have a higher debt to asset ratio compared to a company with a lower cost of entry, such a social media company.

Here are a few examples of average debt to asset ratios by industry from 2020 IRS records (source: https://www.readyratios.com/sec/ratio/debt-ratio/):

Some of the values above might seem obvious- like the motion picture business having significant overhead compared to other industries and others might be less obvious, such as chemicals and allied products (don’t they need significant property and supplies?). This is where several other factors and questions come into play such as, what is the average number of years in business for companies in each industry? Do certain industries always retain debt loads even once established?

Regardless of the precise debt to asset ratio calculation used or the type of industry, a lower debt to income ratio will represent a more stable company, with a greater ability to borrow during times of growth or stress. If the methodology for calculating the value stays consistent and companies are compared within their peer group, this can be a helpful tool for assessing the strength of the company.

The Limitations of Using Debt to Asset Ratio

Multi ethnic business people, entrepreneur, business, small business concept, Woman showing coworkers something on laptop computer as they gather around a conference table.

When looking at the balance sheet from earlier in the article, there are a several financial values that are ignored in the calculation and in certain cases other ratios might be more helpful. For example, a commercial lender might look at debt to tangible assets (excluding intangible assets) as an important ratio because some intellectual property, while valuable, can’t necessarily be used to help with debt liquidation.

Another example would be that including Accounts Receivable as part of assets only tells us so much. For serious consideration of a company’s full situation, you’d want to actually see the accounts receivable book to find out, if they are actually getting paid on all receivables vs. having a portion unpaid.

How does impact my stock picking?

If you read this article to be able to better analyze companies for stock picking, it should be clear by now that there is significant analysis that goes into company ratings. Financial professionals have years of education and training to be able to deep-dive into these balance sheets and analyze all the variables mentioned above and more.

If you want to learn about valuation of companies then debt to asset ratio is a start but several other ratios and variables (such as the ones mentioned above) should be included. Ultimately, many amateur investors end up underperforming mutual fund companies when comparing long-term stock picking rate of return over average actively-managed or passively-managed mutual fund rate of return.

Therefore, it is ultimately recommended to consult a financial professional for investing for these reasons or at least consider diversified mutual funds over single stock picks.

Summary

Debt to Asset Ratio is a leverage ratio shows the ability of a company to pay off its liabilities with its assets. The more leveraged a company is, the less stable it could be considered and the tougher it will be to secure additional financing. Access to funding allows companies to grow and also to survive in stressful situations such as the onset of a pandemic.

What is a good Debt to Asset ratio? In short, it depends. A lower debt to income ratio will represent a more stable company, with a greater ability to borrow during times of growth or stress. Debt to Asset Ratio is only one ratio of many important factors that determine a company’s strength.

Related Posts:

- Cash Balance Plans Pros and Cons

- What Percentage of My Income Should I Invest?

- FatFIRE Your Way to Financial Independence

- Living a Stealth Wealth Lifestyle

- Solo 401k vs. SEP IRA