Listen Here!

Looking back at my first home purchase, it turns out, I got fairly lucky. I was in a buyers’ market, the home appreciated in value quickly following the purchase, and it was a nice home for my current situation. As you’ll see below, this may be one of the rare times that the benefit of short-term home ownership outweighs the cost of buying and selling a home within a couple of years.

The Purchase

If you are first wondering how much of a home you can afford, which is an important first step for obvious reasons, reach out to one of our financial advisors who would be able to look at your overall financial position before moving forward.

I purchased my first home in 2010 for $167,000. Technically it closed in January 2011. It was a nice little two-bedroom, two-bathroom, 1,200 square foot condo in a great location. I was across the street from a huge waterfront park with a boat launch on the Willamette River in Portland, OR. The place was located a mile from my office, about 3 miles from downtown Portland, and near the intersection of three freeways to take me wherever I needed to go. I was within a 20-minute drive from pretty much anywhere I wanted to go in the Portland metro area.

Being a buyer in 2010 was fantastic. 2010 was the definition of a buyer’s market. The condo that I purchased for $167,000 in late 2010 was originally purchased in 2007 for over $300,000. Then the Great Recession hit, the bank foreclosed on the property, and I lucked out. There were numerous units in the same condominium complex that were bank owned. I toured a half-dozen other places that were foreclosed within about a one-mile stretch of the area. Nobody was making offers on homes at the time.

On top of that, interest rates were at all-time lows, and I secured a 30-year fixed-rate loan at 4.625%. I refinanced about a year and a half later to 3.5%. This was about as good as it can possibly get for someone buying a property.

Fast forward five years to 2015 and I’m married with a dog, plans to start a family, and we want to relocate to a larger home in a kid-friendly neighborhood in the suburbs. Oh, how times can change! You know what that means, time to find a new place.

The Sale

With upsizing now a necessity, we had to begin plans to sell the place. We actually listed the house for sale a few weeks after our wedding, which I would not recommend anybody do. A wedding or a home sale/purchase are enough to tackle in one year. Do not try both. For a little help on the home buying part (no wedding advice included), our blog post on home buying 101 breaks down some additional tips and things to be prepared for as you buy/sell a home.

For anybody who has gone through the process, you know selling a home is a pain. It’s 10 times more stressful than buying a house. You have to de-clutter, clean all the time so your home is visitor ready, possibly repaint or do other minor touchups, and fix any major issues. On top of that, you will probably want to put some of your junk in storage, so your house is more presentable and looks like a model home to prospective buyers. You can hear more home selling tips in our home selling podcast.

There are also many costs associated with selling a home. The aforementioned ones, along with a large commission of 5 to 6% of the sale price to your real estate agent, plus some closing costs and moving expenses.

The Home Selling Process

2015 was possibly the best year to be selling a house in Portland in recent history. Offers were accepted the same day the house was listed for well above the asking price! It was rare that a house was on the market for more than a weekend.

Condos were a little different because you need a more specific buyer. Also, my unit was on the top floor of a 3-story complex with no elevator. Several visitors said they loved the place, but the stairs with no elevator were a deal breaker. As a result, we had to wait three full weeks before we accepted an offer on our place.

Despite such a lengthy period of time from listing to sale (I’m being sarcastic here), we still made out like bandits. The same place I purchased from the bank for $167,000 I sold less than five years later for $263,000.

I don’t know about you, but most people are pretty pleased when their property appreciates in value 57.5% in five years. That’s a 9.5% annualized growth rate, which is about three times the historical average for residential real estate. Sure, you see TV shows where people buy fixer uppers, give them a healthy dose of TLC and flip them for double what they paid, but that’s TV. That usually doesn’t happen in real life.

The timing of both the purchase and sale couldn’t have been better given my stages of life and how they coincided perfectly. This is about the best-case scenario you can have in a five-year home ownership window.

The Cost of Home Ownership

I usually tell people that if you plan to own a home for less than five years, renting may be more financially prudent than buying. To help illustrate this, I’m going to detail the total costs of owning my condo. Keep in mind, my situation was probably the best-case scenario anyone could realistically experience. I lucked out.

A home purchase will most likely be the largest purchase you ever make, so it is important to make sure you get it right. As you are gearing up to buy a home, talk to a financial professional for guidance as this will impact your financial plan greatly.

As a refresher, I purchased the place for $167,000 in January 2011 and I sold it in September 2015 for $263,000.

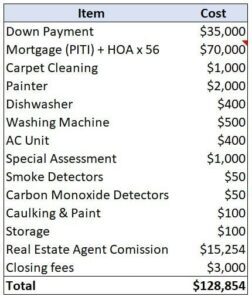

My down payment and closing costs amounted to approximately $35,000 (I put 20% down).

I made a total of 56 mortgage payments. While the property taxes and HOA dues rose over the years, the total payments including taxes, insurance, HOA’s averaged out to about $1,250/month. Multiplied by 56 and I paid about $70,000 during the time I owned the property.

When I moved in, the carpet had a bunch of stains and the walls needed paint. I had the carpets cleaned and hired a painter to repaint the entire unit before moving in. The total for that was about $3,000.

Over the years, I had to replace the washing machine and dishwasher. The unit didn’t have AC, so I purchased a portable AC unit from Costco for my bedroom. I also had to replace smoke detectors and buy carbon monoxide detectors. These items all added up to about $1,400.

The roof and siding on some of the buildings in the complex had to be redone. This wasn’t fully budgeted for in the HOA dues, so we had a special assessment of $1,000.

I also did some minor cosmetic things, such as replace the handles on the cupboards, replace a shower head, and get a new kitchen faucet. Those were done because I wanted them, not out of necessity, so I’m not going to include those costs here, but they’re costs that a typical renter probably wouldn’t incur.

When preparing to move, I re-caulked the bathrooms and kitchen, and we repainted a couple of walls ourselves. The supplies for that added up to about $100. We also put a bunch of stuff in storage for a couple of months, which was about $100.

When the place sold, my real estate agent received a nice commission of $15,254 (which he split with the buyer’s agent) and we had several thousand dollars of seller-paid closing fees (we split the closing costs with the buyer).

If I wanted to, I suppose I could include the $1,000 couch that I purchased and left for the new buyer because we didn’t want to take it with us, and they really liked it.

In total, not including the couch, I paid $128,854 (roughly) over almost five years owning the condo. This doesn’t Include utilities because you likely must pay for those regardless of whether you rent or own.

After the sale, approximately $118,000 hit my bank account. It was awesome to see a $118,000 deposit. That’s about what Damian Lillard makes through about 2 minutes of an NBA game . Go Blazers.

Total spent: $128,000. I walked away with $118,000 after the sale. I basically lived for the equivalent of $2,000/year when it was all said and done. I actually had a roommate for the first few years who was paying me $500/month, so I came out slightly in the black.

That’s way better than renting but doesn’t exactly fit the real-estate-makes-you-rich ideology. When it was all said and done, I recouped all my costs from start to finish. Which is great, free housing!

Keep in mind, this was the best-case scenario I could have possibly experienced owning a home for five years. Given the stages of my life and the timing of everything, it couldn’t have worked out better.

Takeaways

To summarize, the economy was in the tank and hardly anybody was buying homes at the time. I was able to take my time perusing properties until I found one that I liked. From there, I was able to haggle with the seller (bank owned) because there were no other potential buyers making offers. I was able to secure historically low interest financing (at the time) and then refinance to an even more favorable interest rate.

Side note: I forgot to include refinancing fees in my above cost analysis, but whatever. Those were a few thousand dollars.

I made zero significant improvements to the property. After I got married and was ready to move into a larger house, the housing market in Portland was red hot. I was able to sell the home relatively quickly for almost 60% more than I paid only five years earlier.

To sum it up, I was practically dealt seven straight blackjacks after sitting down at the table.

More Realistic Home Ownership Costs

Instead of buying low and selling high, what if it was a more normal economy and economic cycle. Historically, residential real estate appreciates about 3 to 4% per year on average. Depending on who you ask and what part of the country you zero in on, the numbers could differ slightly, but most people would agree with that range.

If my condo appreciated at a more traditional 3.5% per year, I would have sold it for $198,000 instead of $263,000. The commission I paid to the real estate agent would have been $11,484 instead of $15,254, but all the other costs would have been the same. In that scenario, I would have pocketed $69,000 less when I sold it!

Instead of receiving a check for $118,000, I would have received $49,000 and not be living in my current house. Instead of breaking even, owning the condo for five years would have cost me a net amount of $79,000 (not including the approximately $20,000 of rent I got from my roommate). That equates to roughly $16,000/year.

I’m not so sure that would have been better than renting. My girlfriend at the time (now my wife) was renting a similar 2×2 apartment in the same area for about $1,200/month. That adds up to $14,400/year which is less than the $16,000 number I estimated from the prior example. She was also able to simply pack up and leave when her lease was up and not having to worry about finding someone to buy the unit from her.

Things could have been worse. The economy could have been stagnant, and the condo may have sold for the same price I paid.

Or much worse, we could have gone from sky high real estate prices to seeing the property drop in value by 45% (like the previous owner of my condo). I know people who purchased homes in the mid-2000’s who still can’t sell their homes today for more than the purchase price!

Real Estate Long-Term

I do believe that owning a home will be beneficial to your financial wellbeing over the long run. Studies have shown people who own homes have a higher net worth than renters. Not sure if that’s causation or correlation (or maybe an intersection of the two).

If you own a home for a long period of time, there is a decent chance you will recoup the majority of your total ownership costs when you sell it. That is likely much better than renting your whole life. If you want to read more, I wrote a blog titled: Is My Primary Residence an Investment?

Time Horizon of Home Ownership

My goal of today’s post is not to dissuade you from owning a home. My goal is to highlight the costs and risks of short-term home ownership. In my opinion, if you plan to own a home for less than five years, you need to think long and hard about your circumstances before making the purchase.

In many cases, you may be better off financially by renting than owning if it is less than five years.

If we’re in a recession and housing prices are extremely attractive, then sure, your odds of coming out ahead on a short-term purchase may be higher. If the economy is humming along and prices are at all-time highs, then the longer time horizon you have, the more likely owning a home could make sense.

Again, I’m generally a big advocate of owning your home if you plan to stay put for the foreseeable future. For those of you who own homes, you will likely agree with me that the costs are greater than you anticipated before you bought it. I want to make sure you are all aware of the various costs of home ownership so you can make smart financial decisions. In a short time horizon, those costs will likely exceed the returns.

- Related Blog Posts

- Is My Primary Residence an Investment?

- Financial Planning 101: Home Buying

- How Much House Can I Afford?

Related Podcasts