Written by: Corey Janoff

This post was originally published on our previous blog website on April 25, 2017 and has since not been revised and/or updated.

It happens. Maybe you didn’t know the best way to maintain and grow your credit score, or maybe you simply didn’t care before. Life moves on and this silly number goes unattended to, but now you need a credit card, an auto loan, or a mortgage – but your credit score isn’t great… what do you do now?

Depending on the situation, there are different things you may need to take into consideration. It should be noted that regardless of the situation, improving and/or fixing your credit will take time as your credit is an indication of how creditworthy of a borrower you are. By definition, it takes time to build that kind of trust.

If You’ve Never Established Credit Before

If you have parents, siblings, significant others, etc. that have good credit and are willing to help you out on this front, you could ask them to cosign on a debt or line of credit with you. This will help you receive better rates, or turn a decline into an approval. You’re more likely to get declined for an unsecured line of credit (such as credit cards that are not secured with any collateral), or approved with a high interest rate, if you don’t have a credit history and this can be a good way to get started. Secured lines of credit, such as auto loans, may get approved with a lower interest rate, but with a catch. This is because there is collateral associated with the credit they’ve extended you and if you fail to pay your loan back in the specified terms you were given, they can repossess the collateral. That’s the catch. This method of credit building is risky for the person who is helping you as if you miss a payment it isn’t just a black mark on your credit, it reflects on them as well.

If you would rather not rely on building credit with the assistance of someone else, you can look into secured lines of credit to get started. Your interest rate could be higher on an auto loan or whatever it is you are looking into, but as you establish credit you can then look to refinance the loan into a lower interest rate reflective of your credit, or simply use it as a stepping stone to allow you better rates in the future. Additionally, some banks have programs that may be called “Loan Assist” or something of that sort as each bank calls it something different, that allows you to put a set amount of money away into a savings account with them and then “loans” you that exact same amount of money back. You then make monthly payments back to prove that you have the discipline to pay back your debt obligations. This is a good way to build credit for you with no risk to the bank as they “lent” you money that you already had.

If You Have Missed Payments

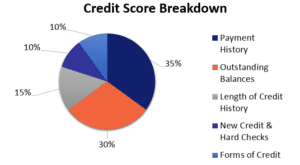

Another common situation is if you have black marks against your credit, the most common of which are missed payments. Approximately 35% of your credit score is determined based on your payment history, with even one missed payment having the possibility of lowering your credit score by dozens of points, if not more.

There are three main credit bureaus that banks (or other institutions that lend money) will look at – Experian, Equifax, and Transunion. The first thing we may try to do is see if we can get these missed payments waived either due to error, or goodwill. The first thing you will need to do is figure out exactly what missed payment occurred exactly when for each credit bureau.

To figure this out for Experian, you can simply use mint.com which helps with budgeting and cash flow planning. They also provide you a credit score from Experian once you set up an account with them. This will allow you to figure out exactly when a missed payment happened and which institution recorded this. Mark down this information as we need to keep track.

To figure this out for Equifax and Transunion, you can go to creditkarma.com and make an account to see a credit score for both institutions. Similar to before, you can figure out exactly when a missed payment happened and which institution recorded this with both Equifax and Transunion through creditkarma.com. Mark down this information.

Now that you have all the information as to the missed payments with the three main credit bureaus, you need to cross reference them and see if some of them have different information. It is very common for one or more of the credit bureaus to have conflicting information, for example maybe Equifax recorded three missed payments in June/July/August of 2016, and Experian/Transunion only recorded two missed payments in June/July of 2016.

Next, you’ll want to draft a credit goodwill letter to each of the bureaus to see if there is any way the missed payments can be waived. You can simply search for “credit goodwill letter template” and there will be many different things that pop up. Read through a few, find one you like, and modify it to your specific situations.

Then you’ll have to send over each individually tailored letter to each of the credit bureaus. It’s important to send this via physical mail to start off. If you don’t hear back within a month or two, you can try emailing/calling to see if any such letter was received and if necessary, send it again.

As a side note, if you notice something to be disputed during your investigation of your credit record (for example, if a credit bureau have recorded a missed payment on a student loan when you were actually on forbearance or deferment), you can send a letter to the credit bureaus regarding the change that needs to be made with confirmation from the bank/student loan servicer/etc. that the black mark in question was never an issue to begin with.

What If The Letter Results In No Action?

Unfortunately, the above method doesn’t always work. It’s not a guarantee by any means and depends on your situation and the credit bureaus. In that case, the only course of action is to look at the components that comprise your credit score and do them all to the best of your ability over the course of several months, a year, or however long it takes.

Make all payments on time, try to avoid maintaining credit balances more than 20-30% of your available credit, try to avoid closing older lines of credit, diversify the type of credit you have (though this may be difficult, hence why we are reading this in the first place), and avoid unnecessary hard checks on your credit (such as applying for an excessive amount of new lines of credit). You can also look at utilizing some of the above methods for people trying to establish credit for the first time.

Final Thoughts

Overall, a solid credit history is one of the most important things to maintain to keep up a healthy financial life. A good credit history can help you receive lower interest rates on loans, qualify for a mortgage, among other things. A bad credit history can be severely detrimental to completing many of the milestones we consider as we go through adulthood.

Understanding credit is a topic that seems confusing to many individuals and hopefully this brings you one step closer to financial independence.