Written by: Corey Janoff

This post was originally published on our previous blog website on July 11, 2018 and has since not been revised and/or updated.

Many of you are probably reading the title of this post with disgust. How could a family who earns $400k per year in annual income, the top 1% of income earning households in America, be living paycheck to paycheck? A few of you are probably saying to yourselves, “I totally sympathize, because that’s me.”

If you read my post last week about making saving and investing a priority, today’s post is going to be a complete 180. As a financial advisor, I have the pleasure (and pain) of seeing the good, the bad, and the ugly of people’s personal finances. And I can tell you with absolute confidence, the more money you make, the more money you will spend. If you fail to set money aside for your financial goals before adopting all the other expenses, you will find yourself in a financial struggle the rest of your life.

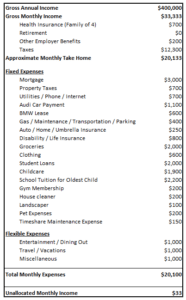

Today, let’s take a look at a hypothetical family’s expenses and see how they are struggling to make any financial progress on a $400,000 annual income. Let’s say it’s a power couple of two high income earners. Maybe a doctor and a lawyer. It could easily be a single income-earner with a stay-at-home spouse. Below is a snapshot of their monthly expenses. After staring at this for a minute, we will break it down.

Income

On a monthly basis, $400,000 equates to $33,333 before taxes. We will assume this particular family of four lives in a high-tax state, such as California, Oregon, New Jersey, etc. They also have to pay a subsidized amount for health insurance and other fringe benefits at work (maybe vision, dental, parking, you name it). Retirement savings is zilch for the time being. These people can’t even think about their future while they are trying to raise young children and pay off student loans.

For those of you familiar with the tax code, you know that Social Security taxes only apply to the first $128,000 (roughly) of income. After that income has been earned for the year, the remaining paychecks will be about 6% larger, because no Social Security tax is taken out. So for part of the year, this family may have a little more wiggle room in the budget, but it will likely get absorbed in home maintenance expenses that just seem to pop up from time to time.

Mortgage Payment

Compared to some of their peers who earn similar incomes as they do, their house is relatively modest. The mortgage isn’t even two times their income! They took out a $600,000 mortgage at 4.375% interest, fixed for 30 years. In some cities, that will get you five bedrooms, a swimming pool, and a large backyard. In other cities, like San Francisco, that will get you a cardboard box.

That being said, this couple is not living in their ideal home. Their goal is to upgrade once the student loans are paid off and they can afford a larger mortgage.

When it comes to real estate, it’s all about location, location, location. For example, I live in a typical suburb of Portland, Oregon, about 16 miles south of downtown. If I were to buy a similar house in a particular suburb that is about 5 miles closer to downtown, it would cost about 60% more than what my house would sell for. Heck, if I stayed within my own town and bought a similar house down by the river, it would cost double! I live in a great neighborhood, in a decent school district, so I have no complaints. If I moved to a town further away or in a less prestigious school district, I would probably pay less for a similar house. Within a short drive in any direction, there is a drastic range of prices for similar homes. This is true in any city in America.

Yes, some cities have higher real estate costs than others. But if you really take the time to look around, you can find a comfortable place to live that fits your budget. It probably won’t be the dream home. Get over it. Life will still be good.

Property Taxes

Don’t forget, the more expensive the home, the more expensive the property tax bill. This family is paying $8,400/year in property taxes. Those roads don’t get paved for free.

Utilities

I’m including cell phones at $150/month, cable & internet at $150/month, electricity at $125/month, gas varies by season, but average of $100/month, water at $125/month, and garbage at $50/month. Not much wiggle room here, unless you stop watering the lawn, or live in a smaller house that doesn’t cost as much to heat.

Car Payments

Yes, this couple is spending $1,700/month on car payments. I have seen much worse. They’re of the mindset that hard-working, high-income earning professionals should drive respectable cars. All of their friends drive luxury cars. They would be embarrassed to be seen in a 10-year-old Honda. Besides, the nicer cars have more advanced technology, which means they’re safer, right? We have young kids to worry about here. Safety first.

Transportation Costs

Those luxury cars require premium gasoline. With both spouses commuting to and from work each day, the gas bill adds up. Also, it costs money to park in the garage downtown where one of them works. Don’t forget toll roads.

Car, Home, and Umbrella Liability Insurance

If you want to drive a car and own a home, you need to have auto and homeowners insurance. Not much you can do about that. It is extremely prudent to also secure an umbrella liability insurance policy (purchased through your home/auto insurance company). This provides additional liability protection above and beyond the limits offered on the underlying home and auto policies.

Disability and Life Insurance

Both spouses know that if either of their incomes were to go away due to an injury or illness, the family would be in a tough spot. Also, if either one (or both) passed away, that would also put a financial hardship on the family. So they have wisely purchased disability and life insurance to protect against those risks. They are probably under-insured, given their needs, but it is better than nothing.

Groceries

Yup. $2,000/month. Do you have young kids? Diapers aren’t cheap. Also, this family is trying to live a clean and healthy lifestyle. They believe in using natural products, eating fresh produce, organic everything when possible. I can’t fault them for wanting to be healthy. Although, half of the produce gets thrown out because it goes bad after a few days. They’re working on doing a better job of planning meals, but it is hard when both work full-time and they have two young kids at home.

This row also includes things like toilet paper, paper towels, trash bags, batteries, soap, shampoo, deodorant, makeup, etc. It’s not just food.

Clothing

They really don’t feel like they spend very much on clothes. They probably spend about $100/month on each child. Kids grow so fast, it’s hard to keep up. Luckily, children’s clothes are relatively inexpensive. Then they spend about $400/month on clothing for themselves. The husband might buy a new pair of pants and a couple of shirts. The wife may get a sweater, a new pair of jeans, or some workout pants, since one of the pairs she owns recently ripped.

Student Loans

Fortunately only one spouse had to take out student loans for professional school. The other was about to get scholarships and had help from parents. The $2,000/month is on a ten-year repayment plan. Again, once those are paid off, they are hoping to move into a nicer house in a better school district so they can hopefully send the kids to public school instead of paying for private school.

Childcare and School Tuition

One kid is in daycare at $1,750/month. The other goes to a private elementary school that costs $26,400/year. They don’t feel great about the school district they live in and want their children to get the best education possible. We’re also including $150/month for babysitters so the parents can get out on the occasional date night.

Hopefully their incomes rise as they advance in their careers, because there will be a few years of two private school tuitions until the student loans are paid off. Then they can hopefully move into a neighborhood in a better school district.

Do what you need to do to give your children a great education. However, a lot of a child’s education comes from how the parents interact with them at home. Parents who talk to and read to their children frequently tend to have smarter kids. If you discipline your children and teach them right from wrong, they’ll hopefully grow up to be respectable human beings.

I went to both private and public schools growing up and there were brilliant kids at both and complete screw-ups at both. The school only does so much. A lot of it falls on the parents. If you can afford private school while still being on track to reach your other financial goals, then more power to you.

Gym, Housecleaner, Landscaper

They’re trying to live a healthy lifestyle, so they work out a few days a week at a gym. As a bonus, the gym has a daycare in it to watch their kids while they work out at no additional cost. So when they go on weekends, they can bring the kids along.

They both work full-time and have young kids, so they don’t have time to clean the house, mow the lawn, or prune the shrubs.

Pet Expenses

They have to feed the dog, pay for the occasional vet bill. They also have a dog walker come by a couple of days a week, so the dog can get a good long walk in. The quick 20 minute jaunt in the morning is great, but Fido needs more exercise than that.

Timeshare Maintenance Expenses

Yep, they got suckered into buying a timeshare. But this one is different. You can exchange it for thousands of properties all over the world. Also, if you want to get out of it, they assure you that you can sell it for the same price you bought it for.

It was $30,000 up front and then $1,800/year in maintenance fees. That gets them 1-2 weeks per year (depending on the property) in a suite or condo that is comfortable enough for the whole family. We’ll see if they actually get their money’s worth.

The only thing I’ll say here is, don’t buy a timeshare unless you are retired. Even then, it’s probably not worth it.

Entertainment/Dining Out

Netflix, Hulu, the occasional date night, lunches at work, ordering a pizza, going to a concert or sporting event, taking the kids to the zoo or Disney on Ice…stuff adds up. It doesn’t even feel like they do that much fun stuff, but they spend $1,000/month on restaurants/fast food and a couple of fun activities.

Travel

For their own sanity, they need to take a couple of vacations every year. With the timeshare, they don’t have to pay for lodging on their annual vacation, but they still have to pay for flights and transportation. Also, meals and excursions on vacation cost money. Nobody goes on vacation and sits in the hotel all week.

They also fly to visit out-of-town relatives once per year and there is the occasional weekend getaway to the beach or mountains.

They don’t take a vacation every month, but a few trips per year for a family of four adds up to $12,000 per year.

Miscellaneous

Birthday presents. Car repairs. Home maintenance. Charity. Haircuts. There are always some random things that pop up each month that cost some money.

Retirement Savings

Not happening in the foreseeable future. Their thought is, “If we can just make more money, we will be able to save.” Next time they get a pay raise, they have a goal of enrolling in the 401k at work.

College Savings

Same thing here. Hopefully the kids are smart and can get merit based scholarships, because they are not getting any financial aid coming from a household with a $400k annual income.

In Conclusion

This hypothetical family makes a great income, but isn’t making any financial progress. Even worse, they don’t feel like they are actually enjoying themselves. Yes, they live in a decent home and drive nice cars, but those things don’t make them happy. That commute in rush hour traffic each morning is still miserable no matter what you drive. When they go on vacation, they are busy chasing after the kids and they stress about a mountain of emails to return to at work.

On top of that, they know they need to be saving for retirement and for college for the children, which adds to the stress. They just don’t know where to start. They don’t know what they can realistically cut out of their lives. Their goal is to work harder and earn more money and that will hopefully solve their financial woes.

Life would be a whole lot easier for this couple if they started with their financial goals, made them a priority, and let the rest of the pieces fall into place. Once you start spending $2,000/month on groceries, it is very difficult to cut back to the spaghetti and top ramen diet. Once you start driving a new BMW, it will be hard to swallow your pride and trade it for a cheaper used car. Aside from retirees downsizing, or people relocating to a less expensive state, I haven’t seen anyone spend less on the next home than they did on their current home.

I could have made these numbers look even worse. I could have used a $1,000,000 home instead of a $600k one. In some cities, $1 million doesn’t even get you much. I could have made the travel budget much larger, the property taxes more, more expensive schools for the kids, more on clothing. I could have added country club dues to the mix. Parental support. There is no limit to what people can spend money on. So, before the spending gets away from you, make sure you prioritize your financial goals and commit to achieving them.