Written by: Corey Janoff

This post was originally published on our previous blog website on September 5, 2018 and has since not been revised and/or updated.

Continuing with the Financial Planning 101 topics, this week we will be diving into saving for retirement. For a full list of subjects to be covered, see this post. I have written a handful of posts about saving and saving for retirement. Please read those for a more in-depth focus on the topic. Today we will talk about some general concepts and ideas surrounding saving for retirement so you can get on the right track.

How Much to Save for Retirement

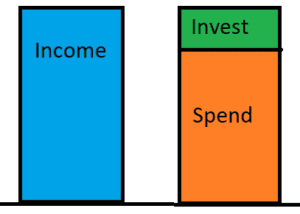

I have written before that I recommend people invest at least 20% of their gross income for retirement. The sooner you can start doing that, the easier it will be. We have done the math enough times to conclude that if you can save at least 20% of your gross income for retirement each year for 30 years or so, that should put you in a pretty good position to be able to retire and live a similar lifestyle in retirement to the lifestyle you grew accustomed to while working.

That was a really long sentence. Let’s break it down.

Save 20% of your gross income. This is your total income before taxes. If your salary is $200,000 per year, I want you to invest at least $40,000 per year for retirement.

Do that for 30 years or so (ie, the bulk of your entire career). If you start working in your early to mid-20’s and invest 20% of your income until your mid-50’s, you might find yourself in a good position to retire in your mid-to-late-50’s. If you are a physician and spent more time in school/training, or just took a while to find yourself before settling into a career and don’t really start investing until your mid-30’s, investing 20% should put you on track to retire in your mid-60’s.

Live a similar lifestyle in retirement to the lifestyle you grew accustomed to while working. This is key. A lot of people who only save 5% of their income are able to retire one day. They just don’t have a very enjoyable retirement and often have to cut back on a lot of expenses in order to make ends meet.

One overlooked component of investing 20% of your gross income is that it gets you used to living on 80% of your income. Using the $200,000 income example from before, if you are investing $40,000 of that for retirement, it means you are only living on $160,000/year before taxes. That 20% difference in income/lifestyle is a 25% difference in how much you need to actually accrue in a retirement account.

For example, if you want to live on $160,000/year in retirement in today dollars, you will need a $4,000,000 portfolio in today dollars to support a 30 year long retirement. If you want to live on $200,000/year in retirement, you will need a $5,000,000 portfolio. $5 million is 25% more than $4 million. More on this later.

What if I Can’t Save that Much?

Many of you are probably thinking, “I can’t afford to invest 20% of my income for retirement.” Most of you who are reading this actually can afford to do so, you are just choosing not to. If you earn a six-figure income, you are in the top-10% of income earners in America (technically $130k and above is top 10% as of 2018). If you are in the top decile of income earners in America and you can’t “afford” to invest 20% of your income for retirement, then you have a spending problem. You read that correctly. Deal with it.

Now, my goal isn’t to beat you up too much – I’m here to help you get on the right track. If you catch the problem early enough, it can be corrected. Without completely uprooting your family and revamping your entire lifestyle, we can get to the 20% savings mark within a few years.

First thing I challenge you to do is to start investing a little more than you think you are comfortable doing. If you think 10% of your income is the max you can invest, do 12%. If you only think you can save 5%, start with 8%. You can always lower it if you have to. I have found the hardest part people have about saving for retirement is getting started. Once you begin, you will find it isn’t as painful as you thought it would be. Humans are very adaptable creatures and we will quickly adapt to the new environment we are thrust into. I am guessing you won’t notice much difference in your lifestyle once you start investing more for retirement.

Next thing I challenge you to do is a strategy called “save more tomorrow.” Many employer retirement plans have a built in feature that you can select to automatically increase the amount you contribute to retirement each year. Also, I encourage you to increase the amount you are investing for retirement every time you get a pay raise and any time you pay off a debt. If you have a $400/month car loan that gets paid off, immediately start investing that $400/month into retirement. Before you know it, you will be investing 20% of your income for retirement.

Where Should I Save for Retirement?

First place I like to see people invest is in accounts that offer tax benefits. Max out your tax-advantaged accounts before investing elsewhere. Not only do most qualified retirement accounts offer tax advantages, many of them are also highly protected from creditors and litigators (check your state laws for specific rules that apply in your state).

Most of you probably have access to a retirement plan through your employer. Money invested in these accounts will grow tax-deferred and you will also likely get a tax-deduction when you contribute money to the account. If you make Roth contributions to the retirement plan at work, you can withdraw the money tax-free in retirement. We will go more in depth on the tax-treatment of investment accounts in the next post.

If your employer doesn’t offer a retirement plan, tell the boss to reach out to yours truly at Finity Group and we can help your company set one up. It isn’t as complex and expensive as people may think.

Investing through your employer’s retirement plan is the easiest way to start, because the money can be automatically pulled from your paycheck each pay period.

Next, Individual Retirement Accounts, also known as IRA’s are great. If you are allowed based on your income, a Roth IRA is ideal, in my opinion, because the withdrawals in retirement are tax-free. If your income is too high to contribute directly to a Roth IRA, you may be eligible to still get money into a Roth IRA via the Roth conversion strategy (commonly referred to as the Backdoor Roth IRA).

Beyond that, Health Savings Accounts can offer those with high deductible health insurance plans another place to invest tax-deferred. You can withdraw the money in a health savings accounts tax-free at any time to pay for qualifying medical expenses. After age 65, you can withdraw the money for any reason, but will have to pay income taxes on distributions not used for healthcare. Basically the same as most other retirement accounts.

After you have maxed out your conventional tax-deferred investment accounts, there are plenty of other places to invest. Depending on your situation and goals, some vehicles may be more attractive than others. I don’t really care where you invest your money as long as it is well thought out and diversified.

How Much Do I Need to Retire?

Remember that tidbit earlier where I said you need $5 million to support a $200k/year lifestyle, but you only need $4 million to support a $160k/year lifestyle? That comes from the 4% withdrawal rule. This is a rule of thumb that has been back-tested against historical market returns. The gist of it is, you can withdraw 4% of your initial retirement portfolio balance each year, adjusted for inflation, and there is a high probability the money will last at least 30 years.

Obviously there are no guarantees moving forward. If market growth in the next 100 years isn’t as good as the last 100 years, a 4% withdrawal rate may not last as long.

So how much do you need to accrue in order to be able to retire? Well, first we need to figure out how much you need to support your lifestyle. Some expenses will go away once you reach retirement. For example, you will no longer be saving for retirement when you are retired. If you estimate you need $160,000 of income/year in retirement, multiply that by 25 to get the total sum you have to have in your retirement portfolio. 4% is one 25th of 100. #Math.

If you want to live on $100k/year, you need $2.5 million in order to retire. If you want to live on $250k/year, you need $6,250,000.

Now, you are going to cringe when you read what’s next. These numbers are in today dollars. We need to factor inflation into the equation. At a 3% historical inflation rate, cost of living will double every 24 years. If you are 36 years old now and want to retire at age 60, you have to double the amount you want today to get the amount you need at the start of retirement.

If you are 36 and want to live on $100,000/year if you retired now, you actually will need $200k/year to live that same lifestyle 24 years from now. That means you need to have $5 million saved up by age 60 instead of $2.5 million.

Moving on…

Some Parting Thoughts

If you are able to put a check mark next to the retirement savings box, then congratulations. Keep up the good work. Feel free to save more if you want to retire sooner.

Some of you are probably looking at your computer screen now the same way you look at the scale when you go to the doctor’s office. You’re probably thinking to yourself, “I gotta get in shape.” It will be a lot easier if you start now. Don’t procrastinate. Take baby steps. You need to walk before you can run. If you are training for a marathon, you don’t usually get up off the couch and run 26 miles a day. Just start with something, anything, and work your way up from there.

Disclosures:

These are general thoughts and guidelines and may not be appropriate for every individual. Consult with your financial advisor to determine an appropriate retirement savings strategy for your unique situation. Any investment involves potential loss, including total loss of principal. This is not to be construed as tax or legal advice. Consult with your tax and legal advisors for particular advice pertaining to your situation.