Written by: Corey Janoff

This post was originally published on our previous blog website on September 12, 2018 and has since not been revised and/or updated.

After last week’s Financial Planning 101 topic: Saving for Retirement, we should now have a decent idea of how much to invest for retirement and what accounts to use. Now we need to know some basic principles of investing so we know how to invest the money.

We will discuss some of the basics of investing, including diversifying, rebalancing, active vs. passive investments, and timing the market. This will be a two-part post, so be sure to read next week as well. Let’s dive in!

Diversifying Investments

When it comes to investing, one of the first things people think of is diversification. Gotta be diversified. Well, what does that actually mean?

Most people think diversification means that you should spread your money around and invest in different things. Absolutely true. This is called asset-class diversification. Investing in different asset classes. Not everyone knows exactly how to go about doing this, but they get the general idea.

There are two other ways to diversify money that are equally important, yet often overlooked: Time horizon and tax treatment.

Investing by Time Horizon

The first thing people should ask themselves before investing any money is, “When do I need this money back?” The answer to that question will help dictate what type of account you should put that money in and how you should invest the money within that account. The money you need in the near future should be invested differently than the money you don’t need for a long time.

Short Term

For example, if you are saving up for a home down payment and you plan to purchase the home within a couple of years, that money should be accessible and invested very conservatively. If you need the money within two years, you don’t want it tied in an account that can’t be accessed without penalty until you are 60 years old. Also, you don’t want it invested in anything that could potentially go down in value.

Last thing you would want is to invest the money you need for a home down payment in stocks. If the stock market goes down in value, it will bring your account value down with it. Now you have less than what you initially planned for when you actually need the money! That could possibly delay the home purchase or prevent you from buying the house you had your sights set on.

Long Term

On the flip side, money you don’t need for a long time should be invested aggressively in assets that have the potential to grow in value over time. Stocks would be great for this. If you are investing for retirement as a 30-year-old, odds are you have another 30+ years to go until you will actually need that money. And hopefully you have another 30+ years of life in retirement! So that money might have a 60 year time horizon!

Thanks to inflation, cost of living goes up over time. At a 3% inflation rate, cost of living will double every 24 years. Therefore, you need your long-term money to grow significantly. The only way to get it to grow is to invest in assets that give you significant growth potential over time. Now, there may be years when those assets go down in value, sometimes significantly. But if you are 30 and your retirement account goes down in value by 40%, now what? You weren’t planning on retiring anytime soon, so it’s ok. You have plenty of time for the account balance to rebound and recover and continue to grow.

The last thing you want to do with your long-term money when it goes down in value is to bail on the investment strategy and move your money to something more conservative. That is a death sentence. You will be all but guaranteed to miss out on the recovery.

To summarize, with short term money be conservative. With long-term money be aggressive. Stay disciplined and stick to that mindset and you will do just fine from an investing standpoint.

Investing by Tax Treatment

Once you know when you need your money back, you can figure out what type of account to put it in. Every time of account has its pros and cons. There is no perfect account out there.

Checking/Savings Accounts

For example, the money in your checking and savings accounts is safe, and you can get to it when you need it. The downside is there isn’t really any growth potential (banks give you peanuts for interest right now) and there are no tax-incentives. Money has already been taxed by the time it lands in your checking account.

Non-Retirement Investment Accounts

Most non-retirement investment accounts are great for their flexibility. There are no limits on how much you can deposit. You can get to the money whenever you need it. You can invest in pretty much anything you want to. The downside is taxes. Every year that you realize a gain in a regular old investment account, you get to pay taxes on that gain. Those are called capital gains taxes.

You don’t need to be a tax expert (we’ll leave that to the accountants), but capital gains taxes are pretty straightforward. You are already familiar with income taxes. When you earn income, you pay income taxes. The government usually takes the money from your paycheck before you even get paid. Well, when your investments make you money you have to pay taxes on those investment earnings in the year you realize them. Similar to income taxes, but at a different scale.

Realizing Gains

There are several ways you can realize a gain and owe taxes as a result. First is if you sell an investment for a gain. Say you buy a stock for $100 and sell it a few years later for $150. You now have a $50 gain that you owe taxes on.

If an investment you own pays a dividend, you have to pay taxes on the amount of the dividend. For example, if you receive $1,000 of dividends in a year, even if you reinvest the dividends, you still owe taxes on that $1,000.

Lastly, if a mutual fund you own distributes a capital gain, you have to pay taxes on it. A mutual fund is simply a collection of a securities. It could be stocks. It could be bonds. It could be real estate holdings. Whatever that mutual fund invests in, it is a large number of those things. Think of a stock as a slice of pepperoni. Think of a mutual fund as a pizza with pepperoni, sausage, peppers, and mushrooms. A mutual fund holds a bunch of stocks in one big pie. Well, if the mutual fund sells some of its positions for gains, you are responsible for paying the taxes on those gains.

It is usually a good thing if you are paying capital gains taxes – it means your investment are making you money – so you can’t complain too much.

Retirement Accounts

Retirement accounts are the most tax-favorable investment accounts out there. Pretty much all retirement accounts grow tax-deferred (meaning, you don’t pay capital gains taxes in years you realize gains). As long as the money stays in the account, the money can grow and compound and accumulate without you owing a penny in taxes. Pretty sweet.

Depending on the type of retirement account, there may be additional tax benefits on the front end or back end. We will discuss those in a moment.

The downsides to retirement accounts are there are limits on how much you can deposit into them each year and you have to wait until you are at least 59 ½ years old until you can touch the money.

Now, there are many different retirement accounts out there. 401k, IRA, 403b, 457, 401a, SEP, SIMPLE, you name it. All you really care about is how the money is taxed going in and coming out. It is really easy to determine this. The key word is “Roth.” If the retirement account has the word “Roth” included, it is taxed one way. If it doesn’t have the word “Roth” it is taxed another way.

Pre-Tax

If you are contributing to a retirement plan and it does not say “Roth” in the title, there is a 99% chance it is a pre-tax account. Pre-tax is the default for most employer-sponsored retirement accounts. Pre-tax means that you deposit money into the account before being taxed on that money.

For easy math, if you earn $100,000 in a year and contribute $10,000 pre-tax into the retirement account at work, the IRS is only going to tax you on $90,000 of earnings for the year. Pretty cool. It’s like the IRS is high-fiving you for saving for retirement. Nice government we have.

The money invested in the account hopefully grows and all growth is tax-deferred. None of that capital gains business.

You have to wait until you are at least 59 ½ to withdraw money from the account. If you withdraw money from the account before you are old enough, you are penalized and pay extra taxes. On top of that, every time someone withdraws money from a retirement account before they are supposed to, an angel loses its wings. So DON’T DO IT!

Now once you are old enough and eligible to withdraw your money without penalty, can you guess what happens? You didn’t pay taxes on the income that was deposited into the account. You didn’t pay taxes on any of the investment gains over the years. What are the two things that are certain in life? Death and taxes. So when you withdraw the money from the pre-tax retirement account, you get to pay taxes at that time.

Whatever amount you withdraw in a given year is treated as earned income. You could be completely retired, not working at all. If you withdraw money from your retirement account, the IRS treat the amount you withdraw as if you worked and earned it as income for the year. And you pay taxes at whatever income tax rates are at that point.

Roth

Roth accounts work the opposite of pre-tax accounts. If it says “Roth” in the title, or you are making Roth contributions to the retirement plan at work, there is no tax-deduction up front. If you make $100,000 in a year and deposit money into a Roth account, the IRS still taxes you on $100k of income that year. No high-five from the IRS for saving.

Same rules along the way – money grows tax-deferred and you can’t touch it until you are 59 ½ years old. If you touch it before then you pay extra taxes and an angel loses its wings. But once you are old eligible to withdraw the money, it all comes out tax-free!!!

Who doesn’t love tax-free income in retirement? Just typing the words “tax-free” makes me want to do that floss dance that all the kids are doing these days.

Diversifying by Tax Treatment

Who knows that taxes will look like in the future. Every time we get a new president, that person wants to change taxes around. So you can expect tax rates to change every four to eight years. That is why it is helpful to have accounts that are treated differently from a tax standpoint.

Most of your buddies will only have pre-tax money available to them in retirement. So it will be 100% taxable as income. Why? Because they didn’t think, they didn’t plan, they didn’t read this blog post or work with a financial advisor. They simply checked a box when they got hired, so all of their money is in a pre-tax account.

But you are different. You are going to be financially prepared for your future. When you are retired, you are going to have options, because you will have money in all of these accounts.

When you are retired, in years where taxes are really high, let’s pull money from are Roth accounts and get the money out tax-free.

If a new president comes in and slashes tax rates to an all-time low, let’s pull from our pre-tax accounts in those years and pay income taxes at the low rates. Save the tax-free money for when tax rates are higher.

Depending on what capital gains taxes looks like, you can utilize those accounts as well.

By having different accounts that are taxed differently, you will have some flexibility when it comes to withdrawing money and can somewhat control what your taxes will be from year to year. This helps you reduce the total amount of taxes you will pay in retirement.

Investing in Different Asset Classes

This is the piece of investment diversification that people are most familiar with. Spread your risk around. Don’t put all of your eggs in one basket.

This is where investing mutual funds makes it easy for investors with even small amounts to be well diversified. Remember, a mutual fund is like investing in an entire pepperoni pizza, rather than an individual slice of pepperoni. If one piece of pepperoni gets burnt, or one gets stuck to the top of the pizza box, you have plenty of other slices on the pie to enjoy and deliver value to your taste buds.

Not only do you want to invest in different companies, but also invest in different sectors of the economy and different regions of the world. Large companies, small companies, healthcare companies, real estate, US, Europe, Asia, up and coming world economies, you name it. There are opportunities everywhere for investors to grow their wealth. It is difficult to predict in advance which areas will do better, or worse, than others. That is why you want to spread the risk around different areas.

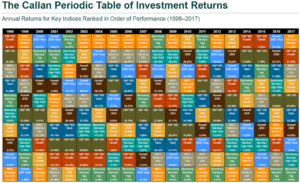

Take a look at the below table. This is a chart that an investment research company called Callan puts together every year. It shows the investment returns of individual asset classes relative to one another over a 20 year span. Each year ranks the asset classes (measured by a respective index) from best-performing to worst-performing in that given year. Each color represents a different asset class.

As you can see, there isn’t much of a pattern here. There is no rhyme or reason as to which asset class will do well in a given year, based on the previous year, or what other asset classes have done. Bottom line, there is no way to predict the future.

Because we cannot accurately predict the future with any consistency, we shouldn’t try to. Rather than trying to do research and watch the financial news to figure out which areas might do well, you are far better off simply staying disciplined and diversified.

Let your financial goals and time horizon for the investment dictate how you invest the money. If you have a long way to go until you need your money, spread the risk around different areas, but allocate a larger percentage of your money to the riskier areas that give you more growth potential over time. More stocks. More small companies. Emerging markets. Yes, those areas also will give you a greater probability of seeing a decline in value in the short-term. However, because you have time on your side, you can afford to ride out those bumps and bruises and let the investment recover and grow exponentially.

As you get closer to needing your money, still be diversified but allocate a larger percentage of your money to the more conservative areas. More large companies, more bonds, CD’s, cash – areas that won’t fluctuate in value as much. You won’t see big gains, but you are also less likely to experience major declines in value.

So turn off the news. Stop reading the financial times to try to figure out what is going to happen next in the world so you can invest your money accordingly. Simply focus on your financial goals and the time horizon you have to reach them.

You will spend less time on your investments this way, lose less sleep over them, and probably end up seeing better returns over time compared to your buddies who are constantly meddling with their portfolios.

Next Time

Tune in next week for a continuation of Investment Principles as part of our Financial Planning 101 crash course.

Disclosures:

Any investment involves potential loss, including total loss of principal. Consult with your financial advisor before implementing an investment strategy.