Written by: Peggy Haslach

“My CPA says I need to set up a SEP IRA!” When I hear that, I usually reply, “Congratulations! Typically, when I have someone asking about SEP IRA for their 1099 income, I know their business has reached a point where they could benefit from setting up a SEP… or for that matter a Solo 401(k), SIMPLE IRA, or Keogh plan. Did your CPA mention any of these? Or perhaps discuss the difference between a Solo 401k vs. SEP IRA?”

“Nope, they just said a SEP IRA. And, by the way what is a Solo 401(k)? Aren’t they expensive? I thought only big companies had 401(k) plans.”

Before I answer, I ask them “What led to your CPA to suggest a SEP?”

That’s when they tell me that they are paying too much in taxes and are not saving enough for retirement. That is not a bad problem to have and most likely their CPA thinks that their business is generating enough revenue for them to start thinking about ways to save more and reduce their taxes. If that is the case, then a SEP or a solo 401(k) would be beneficial, especially if there is only one employee, the practice owner.

The reason that the SEP IRA is typically brought up is because they have been around the longest and they are relatively easy to set up. Most financial advisors can set them up in a flash. Solo/Self-employed 401(k)’s or a One-Participant 401(k) Plan as the IRS likes to call them, have a few more rules and that sometimes prevents financial advisors and CPA’s from suggesting them.

Solo 401k or SEP IRA?

It depends. To establish a retirement plan for yourself or your business (or even your side hustle), you need to have 1099 earned income. One earns income through salaries and wages, commissions, profits from your business and self-employment income. It does not include income from investments or any government program like social security.

The amount of earned income you have will also determine how much you can contribute into a retirement plan. For example, if your new business only generates $2,000 in income, the most you can put in any Individual Retirement Account (aka IRA or Roth IRA) is $2,000. That is why the CPA is not going to suggest setting up a retirement account for the business until you consistently make and can contribute more than $6,500 (or $7,500 if you age 50+) to a plan (the maximum allowable Traditional or Roth IRA contribution as of this writing).

I once had a CPA refer a small practice owner to me and when I asked her how much she wanted to contribute to a plan, she said $200 per month. In her case, it made sense to not set up a SEP and she would be better off continuing to contribute to her IRA.

On the flip side, another practice owner was told by her husband that she did not make enough money to establish a SEP. With monthly receipts of $12,000 – $20,000, she did need to set up a SEP IRA. She did and now she is looking to move into a 401(k). There are a few other factors that will determine which is the best starting plan for your business or practice, a SEP or solo 401(k). Let’s go through them.

What is a SEP IRA?

A SEP or Simplified Employee Pension plan has many of the same characteristics as a traditional IRA. In fact, it is built on an IRA platform. The funds can be invested in a wide range of assets including stocks, bonds, mutual funds, and exchange traded funds. These accounts can be opened at a bank, brokerage firm, mutual fund company, insurance company or qualified financial institution.

The rules for distributions and how the funds are handled in retirement are no different than a traditional IRA. In fact, sometimes the business owner will not have to move the account when they retire or close the business. All they need to do is submit a change request that indicates they will not be contributing so the account’s registration should be changed to a traditional IRA. You can easily rollover a SEP IRA into a Traditional IRA as well.

What is the Difference Between an IRA vs. SEP IRA?

A SEP is a true profit-sharing arrangement in that the employer can contribute the lesser of 25% (or 20% for a sole proprietor or single member LLC) of business revenue, or $66,000 for 2023 to themselves and any eligible employee. To be eligible, the employee must be 21, worked for the employer 3 of the past 5 years and receive at least $650 in paid compensation. If the business has eligible employees, then they must set up accounts for each employee and contribute to their accounts every time the owner contributes to their own account.

This is usually not an issue, because the accounts are easy to set up and can be established any time before the business files their tax returns (up to and including extensions). Many business owners will work with their CPA’s and wrap up the entire year’s taxes and determine how much the employer should contribute to each account. That flexibility and ease is one of the reasons why practice owners choose to stay with a SEP.

One thing to note is only the employer contributes money to the SEP – employee contributions are not allowed.

You can still fund a Traditional or Roth IRA, in addition to the SEP. However, the Backdoor Roth IRA is not allowed, as a you can’t have any pre-tax IRA money and still do the Backdoor Roth, and a SEP is considered an IRA.

Anyone can fund a Traditional IRA or Roth IRA, as long as they have earned income (can contribute 100% of earned income up to the IRA contribution limit). These are completely separate from any employer retirement plans.

SEP IRA vs. SIMPLE IRA

What is the difference between a SEP and SIMPLE IRA? For one, employees can contribute to a SIMPLE IRA, just like a 401k, up to the annual IRA limit ($15,500 in 2023) The employer must match contributions dollar for dollar up to 3% of salary. That’s it. Very simple.

With a SEP, while the contribution limit is much higher, only the employer contributes. Therefore it is up to the employer’s discretion to make contributions.

SIMPLE IRA’s are ideal for single owner practices with a handful of employees, when the owner doesn’t want to contribute the full $66,000 for themselves.

SEP’s are ideal for self-employed individuals, or partners with no employees and similar incomes who would like to save a larger amount for retirement.

Solo 401k vs. SEP IRA for Self-Employed Individuals

The SEP contribution limits and the fact that the employer must contribute the same percentage of salary to all eligible employees are the reasons why many business owners move to a 401(k) plan. The Solo 401(k) is for self-employed and owner-only businesses.

For a Solo 401k (or self-employed 401k), the business cannot have any full time (1,000 hours+) W-2 employees except the owner’s spouse if they are working in the business.

Because the practice owner wears two-hats, employee, and employer, they can make contributions wearing each hat. This allows the owner wearing the employee hat to defer up to 100% of compensation or $22,500 in 2023, plus $7,500 more if age 50+. These contributions can be made on either a pre-tax or Roth basis.

Then, the owner can put on the employer hat and contribute additional amounts up to $66,000 in 2023 pre-tax.

You can also elect to make voluntary after-tax salary deferrals as an employee, on top of the standard $22,500 limit. This can make sense if you are pursuing the mega backdoor Roth strategy and set up the 401(k) plan to allow conversions of after-tax money into a Roth account.

Regardless of the contribution breakdown, the combined total from all sources cannot exceed the IRS max contribution limit ($66,000 in 2023).

The SEP on the other hand only allows pre-tax employer contributions.

Another difference between a Solo 401k vs. SEP IRA, the Solo 401(k) plans allow participant loans that can have the same terms as regular 401(k) plans. The participants can borrow up to 50% of their balance not to exceed $50,000. The term of the loan is 5 years or up to 30 years if the funds were used to purchase a primary residence.

Costs of SEP IRA vs. 401k

The drawbacks on the 401(k) is that it takes a little more work to get them established and they cost more than SEP IRA’s (although the cost should be rather negligible for Self Employed 401(k)’s, especially if the plan is to max fund the account). Plus, the timeline for setting up the plan is much tighter than a SEP IRA. If an owner wants to make contributions wearing both hats, the plan must be established by December 31, 2021. If that deadline is missed, they will be limited to wearing the employer hat and making a profit-sharing contribution for the year.

To set up a Solo 401(k) the owner will need the help of a Third-Party Administrator (TPA) and a recordkeeper in addition to your CPA and financial advisor. These roles work together to put together the plan documents and administer the plan.

This will cost more than establishing a SEP, but the work is done by the plan professionals and the benefits should outweigh the cost. If they don’t, then a SEP IRA would be a better choice. If the owner is on the edge, the determining factor can be their growth potential. If they think they are going to be adding full-time employees and may need more tax savings, then a Solo 4010(k) would be a good start.

One of the dauting pieces of a 401(k) is the plan testing. With a solo 401(k), if there are no employees besides the owner, then testing is not required. The minute employees are hired, then the business must start testing.

If these employees meet the plan eligibility requirements, then they must be included in the plan and their elective deferrals (the employee’s) contribution will be subject to non-discrimination testing (unless the plan is set up as a safe-harbor plan).

The testing is designed to make sure that employers are not benefiting highly compensated employees more than the rank-and-file employees. To me, that is not a bad thing. The reason is that the business is growing.

Moving into a regular 401(k) plan and changing the plan to allow employee contributions, adding a match and other features that would offer the owner additional tax savings. And because all the players are already assembled, it is not that difficult to transition to a regular 401(k). With a SEP, changing plans requires starting from scratch if the business owner wants to add employee deferrals or the other benefits of a 401(k) or qualified plan.

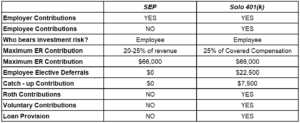

The chart above gives some of the key differences between a SEP and a Solo 401(k). There is one final point that should help point you in the direction of which plan is best for your business or practice.

A Solo 401(k) plan is required to file an annual report on Form 5500-EZ if it has $250,000 or more in assets at the end of the year. A plan with fewer assets and a SEP may be exempt from the annual filing requirement.

Nevertheless, with both plans, practice owners should have an annual check-up to make their SEP or Solo 401(k) are operating within the rules. This would be a good time to evaluate keeping the plan as it is or moving into a plan that better suits the business.

In Summary

As I said in the start of the piece, one of the main reasons business and practice owners seek help is because they want to save more and pay less taxes. Adding a retirement plan can help do that and can be a useful tool to grow your business and attract employees.

SEP’s and solo 401(k)’s are two plans that work well for solopreneurs and one-person practices, but they might not be the right choice for other business entities. Working with a team that can help guide you through all the different types of pension plans, profit sharing plans, deferred compensation plans, and stock plans will allow you to save for the future and avoid taxes in the long run. Isn’t that what we all want?

- Related Blog Posts

- Tax Tips for Doctors

- 10 Tax Deductions for Doctors

- Cash Balance Plans Pros and Cons

- How Much Money Does a Doctor Need to Retire?

- Retirement Plans for Doctors

- 8 Passive Income Streams for Doctors

Disclosure:

This is not to be construed as tax advice. Consult with your tax advisor for advice pertaining to your particular tax situation.